#19 INVESTING IN BONDS THE PT WAY

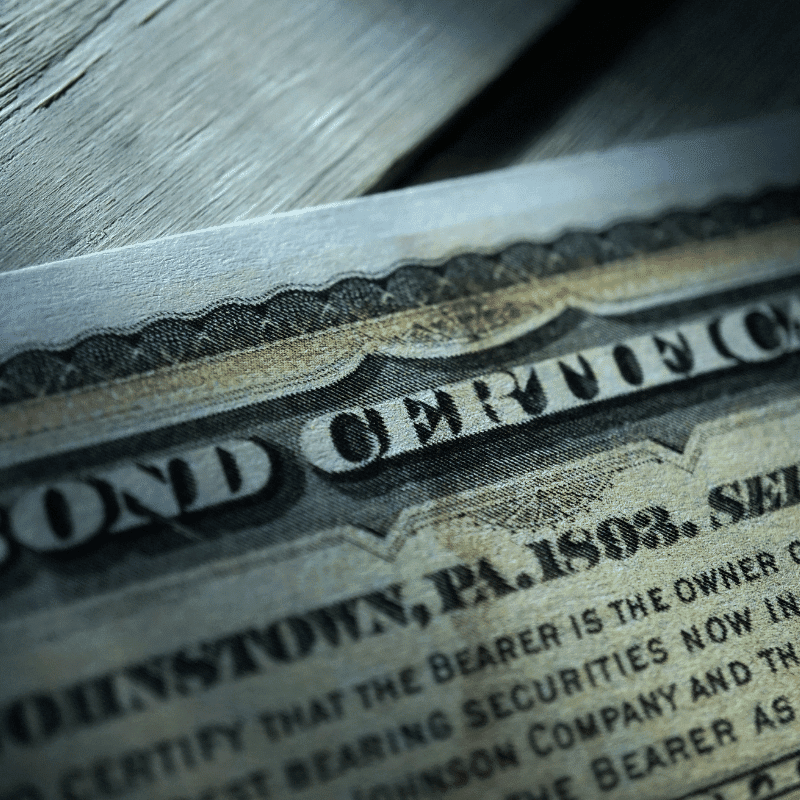

A bond is an i.o.u.from a corporation. It pays interest until maturity or the ”due date” when it is supposed to be paid in full.

In the case of General Motors Bonds, once considered blue-chip and AAA rated, the owners of them will get only a small % of the face value of the bonds. This is because GM is in bankruptcy.

This means they can’t pay their debts. Bondholders will be lucky to get a few shares in the reorganized company.

In the old days, up to 2 yrs ago, you wud just look at Moody’s or Standard & Poors ratings to see if a bond was any good. AAA was unlikely to default. Even a B rating was pretty good. C was “so-so.”

Nobody expected D rated bonds to pay, usually, they were junk bonds ready to be junked.

Then it was revealed that the companies rated could & did pay rating agencies for a higher rating than was warranted. People discovered that some AAA-rated real estate securities shud have been rated Z!

Actually, there is no Z — I am being dramatic.

These days there are plenty of ‘certified financial analysts’ who rate bonds, and many banks like Jyske who actually assemble packages of his interest bonds for investors. They will probably make money [these days 15-20% per year!] & be paid when they mature.

Now here is the hidden gem:

You can contact Gramps directly just by clicking on the COMMENTS below. It may take a few days but your message will be read by Gramps.

If you can come to an agreement with Gramps, he might be able to take you on as a personal consulting client. If not, a more economical option for offshore structuring is Bob Quinn from Kevelex Corp. ask for our Bank

Referral Sheet available free to members from ii-readers@byebyebigbrother.com

Post your comments, thoughts, related personal experiences, corrections or questions below.

Post a Comment

0 Comments